Partial year depreciation calculator

Estimate depreciation deductions for residential investment properties and commercial buildings. We guarantee to find double our fee in deductions in the first full financial year claim or there will be no charge for our services.

Ppt Chapter 8 Powerpoint Presentation Free Download Id 262896

About the Authors.

. Claiming catch-up depreciation is a. Special depreciation rules apply to listed. Gross vehicle weight can qualify for at least a partial Section 179 deduction plus bonus depreciation.

Qualified Liberty Zone property placed in service before Jan. Explore math with our beautiful free online graphing calculator. It helps protect your finances in case of a claim due to physical damages to your car.

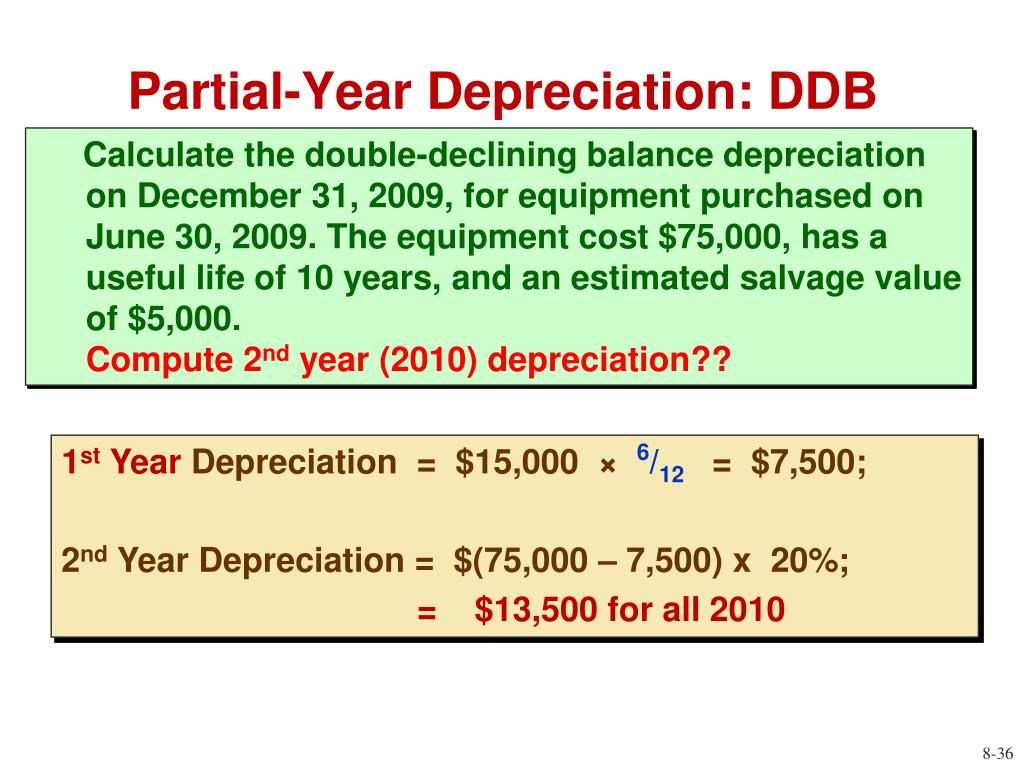

Under thedouble declining balance method the 10 straight line. Tax deductions and additional cash flow by year. It is an exception to the partial interest rule.

BMT Tax Depreciation Calculator. 148 cm x 21 cm z The various appendices describe additional details of calculator operation as well as warranty and service information. A qualified conservation contribution is deductible even though it is a partial interest.

Find out how it works and how it can save you money at tax time. Real estate depreciation on rental property can lower your taxable income. View and update your schedule online track.

For instance if this heat pump requires less than 169 worth of additional capital every year in terms of maintenance and depreciation then it will break even against natural gas. That because if you have opted for a daily reducing balance you will get the benefit of the prepayment immediately. Under Budget 2019 proposals the instant asset deduction was.

Graph functions plot points visualize algebraic equations add sliders animate graphs and more. You didnt claim depreciation in prior years on a depreciable asset. Certain property with a long production period.

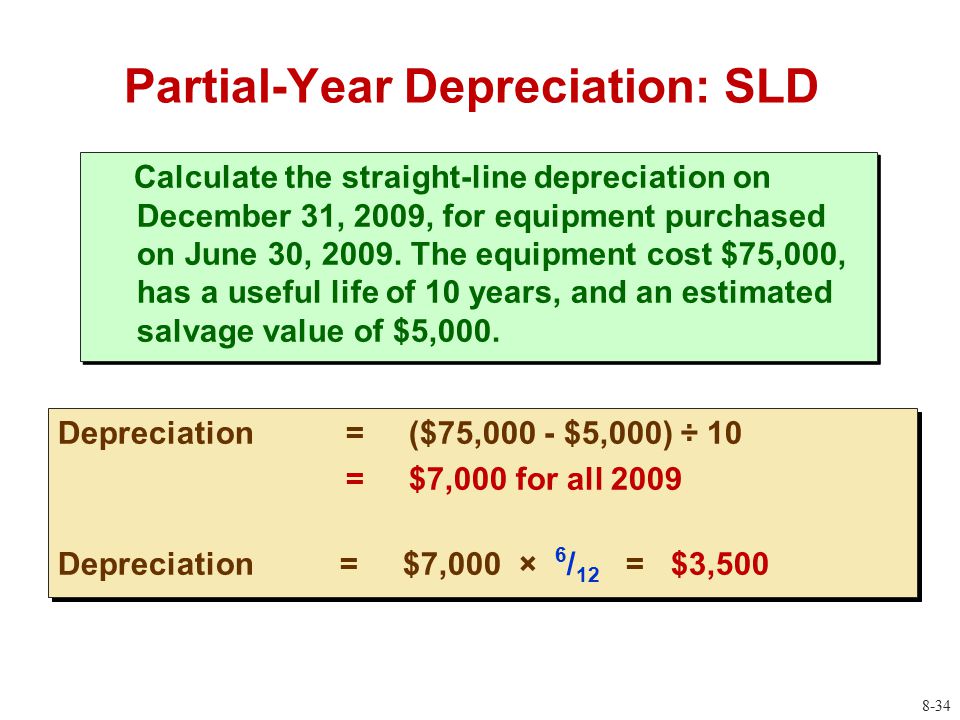

The company should record depreciation of 30000 every year for the next five years. And you make the payment. The Cost Segregation Savings Calculator estimates your federal income tax savings and provides.

If you would like to make a partial prepayment for the next month on 15th of the same month you can do so and benefit from it. IRC 170f3Biii and h. Enter basic building info and instantly receive the estimated.

Obvious work vehicles that have no potential for personal use typically qualify. The salvage value is 15000 and the machines useful life is five years. Tax Rates 2019-2020 Year Residents The 2019-20 tax rates remain unchanged from the preceding year and for the following two years.

General Depreciation System - GDS. The expenses that investors can add to a cost base include but are not limited to. Qualified GO Zone property placed in service before Dec.

These properties might also qualify for a special depreciation allowance. One method is called partial year depreciation where depreciation is calculated exactly at when assets start service. Heavy SUVs Pickups and Vans that are more than 50 business-use and exceed 6000 lbs.

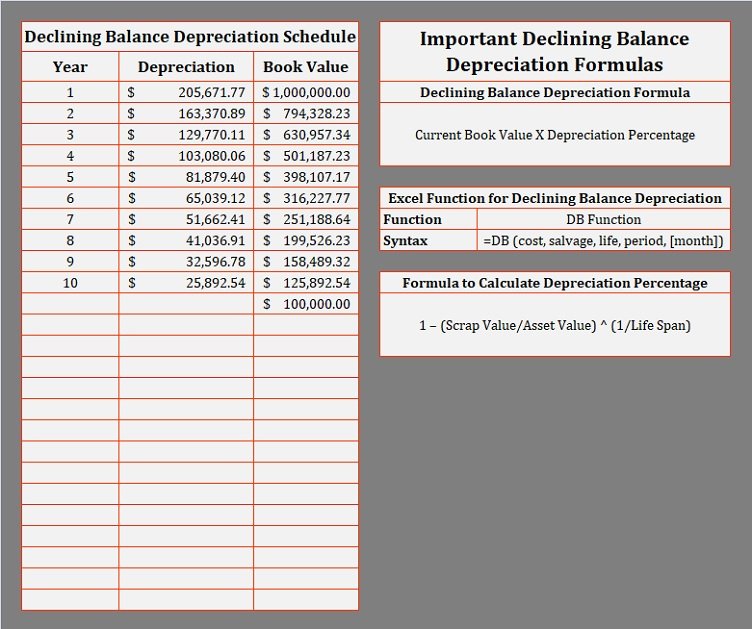

The spreadsheet calculator allows us to calculate a break-even maintenance and install cost. Estimated allocation to 5 7 15 and real property. A general depreciation system uses the declining-balance.

You should claim catch-up depreciation on this years return. For raised breeding stock it is the base value of the animal the cost of raising the animal to that stage eg. As an example a company buys a new machine for 165000 in 2011.

This is where a zero-depreciation add on cover comes into the picture. You claimed more or less than the allowable depreciation on a depreciable asset. A partial interest is generally not deductible.

Amar Patel Director Atlanta Amar spent 14 years at PwC and one year at Centiv LLC focusing on various specialty tax products including Cost Recovery Solutions and Research Development Tax CreditsIn the past 15 years of practice Amar has become an expert in cost segregation and large fixed asset depreciation reviews for purposes. Net present value over 10 years and over the life of the property. An accelerated depreciation rate has also been introduced.

2 Average cost basis is important because it impacts the net income calculation and profitability figures. 4 Introduction File name. Interest in the property.

Catch-up depreciation is an adjustment to correct improper depreciation. Residential rental property. The depreciation rate percentage is applied on reducing balance of asset.

Incidental Costs such as your rental advertisement fees legal fees and stamp duty. Simply select Yes as an input in order to use partial year depreciation when using the calculator. There are low income and other full or partial Medicare exemptions available.

It is common knowledge that the depreciation value of any commodity be it electronics or a car starts its journey southwards as soon as you make a purchase. You may elect to recognize a partial disposition of a MACRS asset and report the gain loss or other deduction on a timely filled return including extensions for the year of the disposition. By convention most US.

This is known as the partial interest rule. Depreciation rules for listed property. In some cases however you are required to report the gain or loss on the partial disposition of a MACRS asset see Required partial dispositions.

Hp 12c_users guide_English_HDPMBF12E44 Page. Ownership Costs such as those incurred when searching and inspecting for properties. Try it for free.

Title Costs such as the legal fees incurred when. In regards to depreciation salvage value sometimes called residual or scrap value is the estimated worth of. The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation.

The average cost basisbase value is purchase price minus accumulated depreciation for purchased breeding stock. 4 of 209 Printered Date. Expenses That Can be Added to the Cost Base.

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach

2

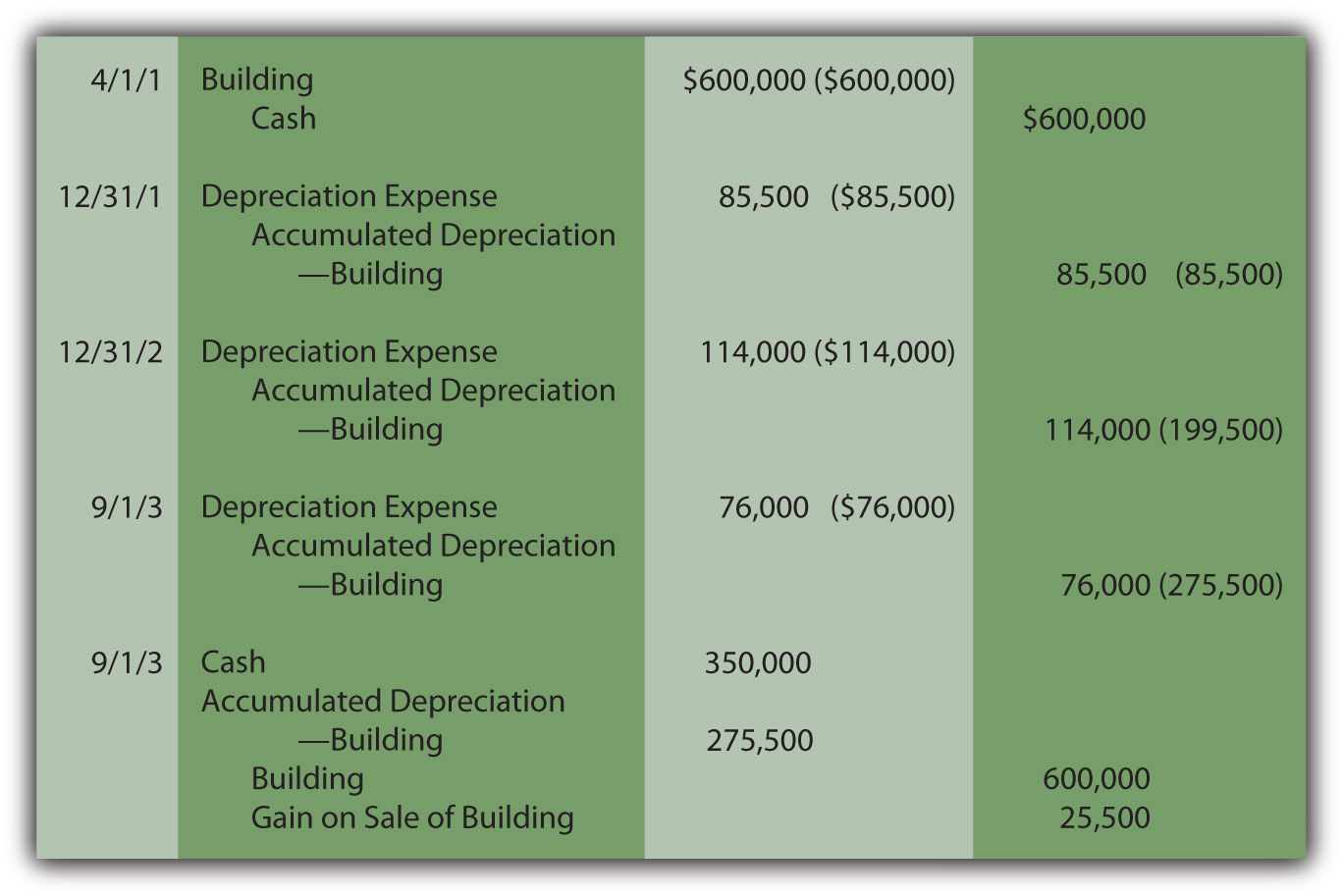

10 3 Recording Depreciation Expense For A Partial Year Financial Accounting

How To Use The Excel Syd Function Exceljet

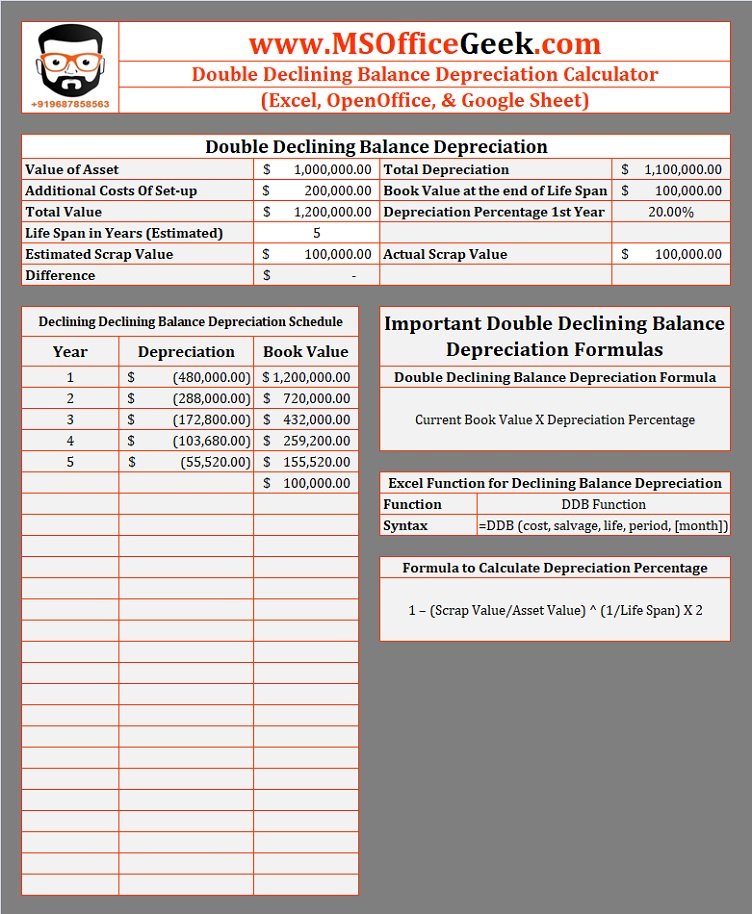

Declining Balance Depreciation Calculator Template Msofficegeek

Long Term Assets Lecture 6 Partial Year Using Straight Line Depreciation Youtube

Declining Balance Depreciation Calculator Template Msofficegeek

Declining Balance Depreciation Calculator

Chapter 8 Long Term Assets Ppt Download

Partial Year Depreciation Financial Accounting Youtube

Practical Of Straight Line Depreciation In Excel 2020 Youtube

Declining Balance Depreciation Calculator Template Msofficegeek

Declining Balance Depreciation Calculator Template Msofficegeek

Depreciation Accounting Sum Of Years Digits Method With Partial Period Allocation Youtube

6 7 Partial Year Depreciation Youtube

Partial Year Double Declining Balance Depreciation Youtube

Depreciation Units Of Activity Double Declining Balance Ddb Sum Of The Years Digits Accountingcoach